Amazon Germany VAT Bottle Deposit Rule: What Changes Next

TL;DR: Amazon’s new VAT rule for bottle deposits in Germany isn’t just some minor change—it could cost sellers €30,000 a year.

Think a tiny rule tweak is nothing? Think again. Soon, Amazon will count bottle deposits as part of what gets hit with VAT in Germany. That’s not just boring paperwork. If you sell loads of soda, juice, or water on Amazon.de, you need to hear this.

Picture this: You’re shipping out thousands of drinks each month. Suddenly, that €0.25 bottle deposit on every bottle becomes a huge pile of extra taxable cash. This isn’t “just some line on your books.” From September 22, 2025, bottle deposits go from a side note to center stage. They’ll sit right inside your VAT numbers.

Want to dodge nasty bills and tax nightmares? Keep reading. We’ll break down what’s changing, why it matters, and how you can use tech to beat the mess. Sure, €0.25 doesn’t sound like much. But stack it over a year and it’s serious money. German tax folks are paying attention.

Key Takeaways

- Starting September 22, 2025, Amazon will add bottle deposit amounts into your VAT tax base for anything you sell on Amazon.de.

- The selling price shown for tax will now include both product and deposit, so your VAT bill grows.

- Automate this with Amazon’s SP-API or Seller Central. Manual work? Too risky—mistakes mean fines.

- Every single drinks seller shipping to Germany—even if you live elsewhere—must record product and deposit separately.

- Ignore this stuff? Get ready for VAT errors and audits.

New Bottle Deposit VAT Rules

What’s Changing?

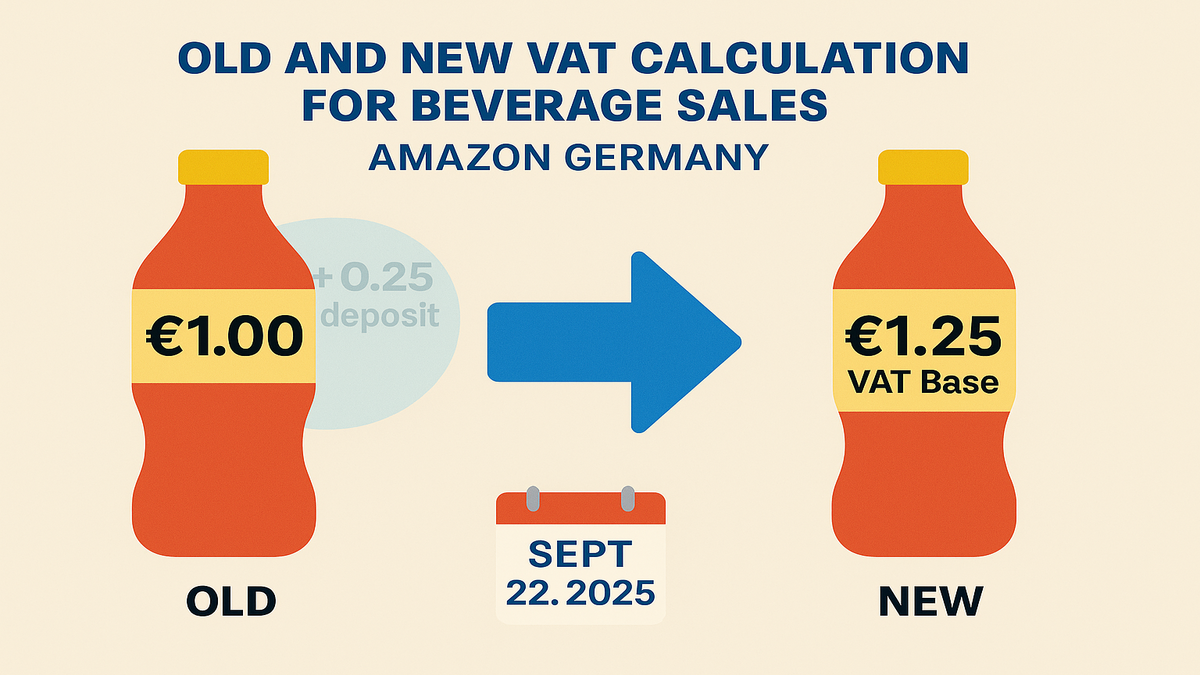

Right now, most Amazon Germany sellers list a drink for €1.00 plus a €0.25 deposit. Amazon’s VAT report used to treat these as separate. So, you paid VAT on the drink, not the deposit.

That ends in September 2025. Amazon will show the combined amount—product plus deposit—in a new "OUR_PRICE Tax Inclusive Selling Price" field. So you charge VAT on €1.25, not just €1.00.

It’s not just some tech tweak. It changes your whole VAT math. Even if you use smart accounting tools or Amazon’s API, you gotta double-check your setup.

Does This Matter?

Yep, if you sell drinks on Amazon.de. Doesn’t matter where you live. Selling German soda or Spanish water—if bottles land in Germany, you have to do this. This rule is for everyone selling drinks to German buyers.

“Including deposits is a way to make sure nothing slips by,” says Marie Körber, a Berlin tax pro. “It connects tax and environmental laws tighter than before.”

So, if you handle listings, taxes, or get stuck with deposit questions from customers (yep, now your problem), you can’t ignore this.

Why Is This Happening?

Why Deposits Matter

“Pfand” laws (that’s German for “deposit”) aren’t new. They make folks return bottles, not trash them. It works: 98% return rate in 2022! (source)

The issue? Taxes. Many sellers only charged VAT on the drink, not on the deposit—sometimes by accident, sometimes ‘cause it was an easy pass-through. It’s been messy because old tools didn’t make it easy to track.

Now, tax offices saw the gaps. Germany and the EU are mixing environmental rules and tax logic. If it’s on the receipt, it counts for VAT. Auditors found out missing deposits meant missed tax. Less tax means less cash from e-commerce, so they fixed it.

The Real Reason

Let’s be real: governments want their fair slice. But they also want to see where all the bottles are going. Tracking every €0.25 means cleaner stats for recycling and tax—plus fewer holes for sellers to sneak through. Lining up tax and bottle data keeps everyone honest.

How This Hits You

Example: The Math

You sell 10,000 one-liter Coke bottles a month on Amazon.de. Each bottle is €1.00, deposit is €0.25. Old system, your VAT tracked €10,000 (drinks only), deposit often ignored.

With the new rule? Your VAT base is now €12,500. Over a year, that’s €30,000 in extra taxable money. VAT on that—at 19%—is no joke. For big sellers, we’re talking tens of thousands. Small sellers could see their profits wiped out if they miss it.

Daily Work Gets Messy

This new rule isn’t just for your finance crew. It touches everything:

- Product vs. Deposit: Don’t just slam these together! Keep them apart in your numbers for returns, margins, and fixing mistakes.

- Reporting: Watch for the “OUR_PRICE Tax Inclusive” field in Amazon reports. Old templates may break after this change, so plan time to update things.

- When Does Deposit Count for VAT? If a customer doesn’t return a bottle (especially foreigners or lazy folks), the deposit could count as real income and get VAT slapped on. You need to know which deposits won’t get paid back.

“Automate all this—or you’re begging for audit pain,” warns Erik Baumann, CFO of a big drinks brand on Amazon Germany.

Even if your VAT has never been a problem, these tweaks could get you in trouble fast.

Automation Isn’t Optional

Manual Won’t Cut It

A surprise tax mess you could’ve dodged hurts worst. Amazon’s VAT service is ready for this change, but only if you use it right.

Manual entry? Spreadsheets patched together? Forget it. Slogging through reports by hand nearly guarantees misses. Use Amazon’s SP-API or Seller Central to pipe reports into your systems.

Want backup? Tools like AMC Cloud can push Amazon’s new numbers straight to your accounting. They auto-check for mismatches, so your books don’t get sloppy.

New Workflow

Think “compliance on autopilot.”

- Amazon adds the full, tax-inclusive price (drink + deposit) in Seller Central and the API.

- Your software matches this with your in-house records each month.

- If numbers don’t match up? You see it fast and sort it out—before the tax guy shows up.

Some sellers set alerts on mismatches. You’ll spot things before they snowball. Better safe than sorry when it comes to tax.

Stay Compliant in 2025

Don’t Wait—Act Now

This isn’t just some “new year, new rule.” It’s a reason to sharpen up sales, stock, and money tracking. Seen fuzzy numbers before? Here’s your moment to clean them.

- Keep Deposits Separate: Always book deposits as their own line. Makes audits and refunds way easier.

- Update Software: Your finance tool should pull in the new Amazon tax-inclusive price every time.

- Team Training: Every staff member—sales, ops, accountants—should do a trial run with these new numbers.

- Monthly Reviews: For the next year, check every month that product and deposit lines show up and match with what you report to tax authorities.

“Audits suck. But if you’ve got automated VAT plus deposits? You’ll sleep fine,” says Sophia Pohl, Munich e-comm consultant.

If you’re still doing VAT by hand or relying on a friend’s cousin, consider this your wake-up call.

Quick Checklist

- Automate checking Amazon’s “OUR_PRICE Tax Inclusive Selling Price” against your own books each month.

- Save full digital records from Amazon’s automated reports. Paper copies are fine for you, but tax folk want digital proof.

- Mark your calendar: Double-check your own VAT totals with Amazon’s new numbers monthly.

- Track returns: Watch which bottle deposits you actually owe back and which ones become income.

- Watch EU tax trends: This isn’t the last change—more may follow, especially around recycling and online sales.

It will seem like a hassle at first, but once set up right, it’ll make your life way easier.

Recap for Sellers

- Bottle deposits become VAT-taxable on Amazon.de starting September 22, 2025

- The “OUR_PRICE Tax Inclusive Selling Price” field now includes deposits

- You must record product and deposit apart, but both show up in Amazon’s new reports

- Automate! You’ll save hours and avoid costly goofs

- Expect more tax-tech tweaks as EU laws get tighter

FAQ: Amazon Germany Bottle VAT

1. When does the new rule start?

September 22, 2025. From then, every drink you sell with a deposit gets reported the new way.

2. Does it cover all sellers, even outside Germany?

Yep. If your drinks land in Germany, you’re in. Doesn’t matter where you live.

3. What changes in the VAT report?

Now the “OUR_PRICE Tax Inclusive Selling Price” column shows both product and deposit—for a €1 drink and €0.25 deposit, the VAT base is €1.25.

4. How do I set up my books?

Keep drink and deposit numbers separate inside your records, but include both in your VAT base to match Amazon. Always cross-check with Amazon’s reports.

5. What if I don’t update my process?

Trouble ahead: Think audits, fines, stress. Automation is a must, not an extra.

6. Is this good for audit trails?

For sure! The new API fields make every transaction clear as day for audits.

Make the VAT Rule Work

- Read Amazon’s reporting guide and API docs—focus on the “OUR_PRICE Tax Inclusive” bit.

- Tweak your sales and money systems: Have separate fields for drink sales and deposit for every order.

- Automate data pulls from Amazon’s API or Seller Central into your accounting. Cut the copying and pasting—errors slip in fast.

- Schedule checks: Once a month, make sure your VAT tracking covers both product and deposit.

- Train your whole team: Everyone, from the sales floor to the accountants, needs to know how to handle deposits now.

- Call in pros if you must: A German VAT expert can help set up the right process, especially if you’ve got tons of sales or tricky products.

So here’s the deal: Bottle deposits aren’t just an afterthought if you sell drinks on Amazon.de. This is about more than paperwork—it’s smart business, peace of mind, and keeping what you earn. Focus now and when September 2025 comes, you’ll be ready. You might even come out ahead.

Want an easier way to automate your VAT work and handle Amazon’s new reports? See how Requery can keep your numbers tidy and your audits short.

Need more Amazon cross-border tax tips or accounting help? Dive into our EU VAT for Amazon Sellers guide. Curious about automating Amazon reports? Check out the official SP-API integration docs.