Avoid SPD Pitfalls: USPS, FedEx Limits in v2024-03-20

Shipping labels are promises. If your API can’t see the box, the carrier won’t make the promise.

Your small parcel flow just hit a speed bump. In v2024-03-20, Small Parcel Delivery (SPD) isn’t fully supported when carton info is unknown upfront. Translation: if you create shipments first and figure out boxes later, your label flow stalls.

This matters because USPS and FedEx labels live and die on carton details. No carton-level data, no compliant labels, no pickup. Meanwhile, Less-Than-Truckload (LTL) keeps moving, because LTL can work with summary data and BOLs. SPD can’t. Different game.

No published timeline for full SPD support—so you need a plan now. Here’s what the USPS and FedEx SPD limits mean for day-to-day, what breaks, and how to ship without wrecking SLAs or margins.

TL;DR

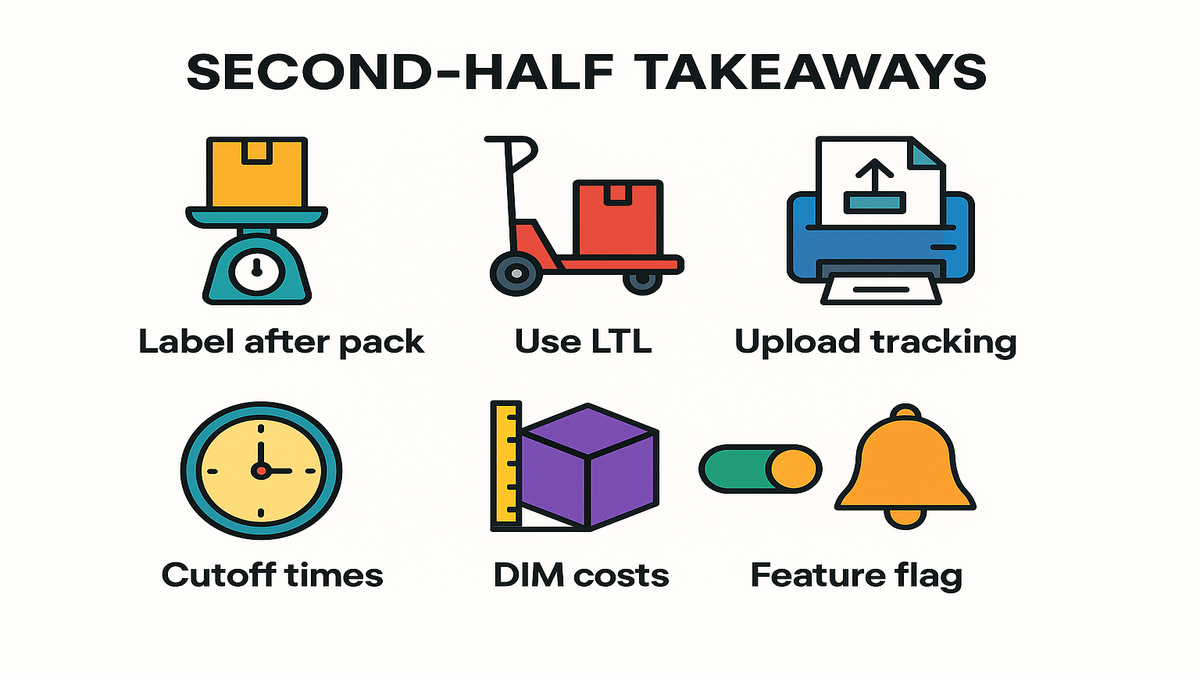

- SPD with unknown carton info upfront isn’t fully supported in v2024-03-20; LTL is.

- USPS and FedEx labels need package-level data (weight/dims/identifier) before printing.

- Short-term fix: push cartonization later, or create labels after pick and pack.

- Hybrid play: offline label creation plus upload tracking to keep orders moving.

- Watch release notes; build feature flags to re-enable SPD fast when support lands.

What no carton info breaks

Why carton level data matters

SPD labels are contracts with carriers. Each parcel needs a unique ID, service code, weight, dimensions, and sometimes declared value. That’s how USPS enforces IMpb rules and how FedEx computes pricing and routing. If the API can’t accept “I’ll tell you the box later,” you can’t make compliant labels or rates in advance.

In practice, your pre-pack flow stalls out. You can’t spin up labels in bulk, then match them to cartons as your team fills boxes. You lose that “pre-print then pack” speed many high-throughput teams rely on today.

Here’s the simple reality: carriers use label data to decide routing, pricing, and audits later. If any input is fuzzy, the system assumes risk you’re underpaying or misrouting, which is why they want final data before label creation.

Quick sanity check: per-carton data isn’t just about money. It ties to tracking accuracy too. If the actual box differs from the label, scans can mismatch and confuse customers. They ask, “Why does tracking say 2 lbs when my box is huge?” Then support tickets pile up.

Your workflow before vs after

- Before: You created an SPD shipment header, batched labels, and let packers slap and go. Carton specifics were finalized during pack.

- After: You must know each carton before you ask for a label. That means cartonization moves earlier during pick and pack, or labels move later post-pack. Either way, you add latency.

First-hand example: You run a Friday drop with 300 orders. Before, you pre-generated labels Thursday night, then packed to those labels. Now, you must cartonize and weigh every box before requesting labels. That pushes label creation into the busiest hours and risks missed pickups.

Expect friction here:

- Dwell time at pack benches goes up as staff weigh and dim every parcel.

- Printer queues spike midday instead of getting smoothed by pre-label runs.

- More station switching (pack → weigh → print) slows down muscle memory.

- Label reprints drop, which is nice, but surge capacity drops during rush.

Small tweaks help recapture speed:

- Standardize a short list of box SKUs; map SKUs to boxes where it fits.

- Put scales and quick-dim tools at every station—no walks to a shared scale.

- Use scan-driven prompts so the system knows the carton and service to call.

USPS vs FedEx carton details

USPS reality check

USPS’ Intelligent Mail package barcode (IMpb) rules expect each parcel to have a unique ID and accurate pre-shipment data. If you use USPS Ground Advantage or eVS, you already play by those rules. Missing or wrong package data isn’t just annoying—it’s a compliance issue that can trigger extra fees or rejected scans.

Operational impact: You can’t print a USPS label for a “future” carton and fill blanks later. The system expects final, per-package details before label generation. That’s how USPS ties your manifest, tracking events, and postage to the real box.

Compliance gotchas to watch:

- IMpb needs valid package-level data that matches your shipment manifest. If not, acceptance scans may misalign, and USPS can assess fees.

- eVS flows expect you to close out shipment data cleanly. If labels don’t reflect actual weights and dims, your postage reconcile can drift.

- Ground Advantage delivery targets are based on first scan. If label creation slips a day, your delivery promise slips too—no magic.

FedEx reality check

FedEx Ship APIs also demand package-level data for labels—weight, dimensions for DIM, and sometimes special services. No final package, no valid label. FedEx Ground pricing is heavily shaped by dimensional weight. If you guess dims too early, you’ll eat margin later or get post-invoice changes.

First-hand example: You quote a 2‑lb candle in an 8x6x4 box. At pack time, your team swaps to a 10x8x6 for protection. DIM jumps, and the “pre-made” label is wrong. Without carton-level support upfront, the API won’t let you run this guess-and-fix cycle programmatically. That guess creates real billing risk.

Dimensional weight 101 (keep it simple):

- DIM weight is L × W × H divided by a divisor. For many domestic FedEx services in inches and pounds, that divisor is often 139.

- Example: 10 × 8 × 6 = 480 cubic inches. 480 ÷ 139 ≈ 3.45 lbs. If the actual weight is 2 lbs, you get billed at 3.45 lbs, then rounded by rules.

- Divisors and rules vary by service and account. Check your carrier docs and label after you know the real box.

Bonus detail: Special services like signature, declared value, or additional handling can change rating and data needs. Don’t ask the API for a label until the station confirms final package details.

Workarounds until SPD support

Move labels later

- Cartonize at pack stations. Weigh, measure, then call the API for the label.

- Batch labels by station or wave after items are already in boxes.

- Use barcode-driven pack flows to cut latency. Scan order → pack → call label API → print.

It’s slower than pre-print, but it’s accurate. Less rework. Fewer voids, cleaner.

Make the “label-later” model fast:

- Pre-cache service rules and eligible methods client-side to avoid extra API trips.

- Default to a best-fit box per SKU bundle; allow overrides only when needed.

- Put the printer within reach and auto-print on success—no “click to print” stalls.

Use LTL for scenarios

When orders cluster to few destinations, LTL might be cleaner. LTL is still supported in v2024-03-20 and doesn’t need per-carton labels. You consolidate, make a BOL, and ship. Not a DTC parcel replacement—but a pressure valve for heavy or multi-case moves.

Practical triggers for LTL instead of SPD:

- Multi-case orders to a single address with total weight over your SPD comfort band.

- Items over size limits or that keep getting hit by DIM penalties.

- Store replenishment or wholesale cases where pallets improve safety and cost.

Hybrid offline labels tracking

If your carrier accounts let you print labels via their tools, or a third-party workstation, based on final carton data, you can ship now. Then upload tracking back into your order system through a separate endpoint. It’s clunky, but keeps SLAs intact.

First-hand example: During a promo spike, you switch a top SKU to a dedicated lane with a fixed box. The packer prints the USPS or FedEx label locally after weighing, and a scanner posts tracking to your OMS. No fancy API gymnastics—just a tight flow.

How to make the hybrid path reliable:

- Use a standard CSV or API endpoint for tracking ingestion; no manual keying.

- Print a secondary internal barcode on the pack slip. Scan to attach tracking in your OMS or WMS.

- Run a daily reconcile: shipments created versus trackings received, so nothing slips.

Keep checkout honest

- Rate at checkout using historical averages per SKU-to-box mapping. Add a safety buffer for DIM-heavy items.

- Refresh those averages weekly from invoice audits to close the gap.

- For bulky items, present delivery estimates conservatively to protect your promise window.

Math time costs SLAs

Time to label impact

Pre-label flows are fast because they move work off peak hours. Without that, you add seconds per box at pack time. Ten seconds sounds tiny until you multiply by 1,000 parcels—nearly three extra labor hours during peak.

Missed carrier cutoffs become next-day scans, which pushes your “order-to-first-scan” metric. USPS Ground Advantage is usually 2–5 business days; FedEx Ground usually 1–5. If the label shifts to tomorrow, your promise just slipped a full day.

Zoom out one level:

- If your team ships 500 parcels per day and labels now happen post-pack, even a 12-second delay adds 100 minutes. That’s a full worker for nearly two hours in your busiest window.

- If 3% of parcels miss pickup because of labeling bottlenecks, your same-day ship rate dips. Customer comms must adjust.

Cost deltas you should expect

- DIM weight risk: FedEx and others bill on dimensional weight when volume is large. Cartonizing late removes guesswork and reduces post-invoice surprises.

- Label waste: Pre-printing labels you can’t use becomes pure waste under strict per-carton rules.

- Labor: Shifting labeling to pack stations may require more printers, scales, and training.

First-hand example: A brand shipping 500 parcels per day at 10 seconds extra per parcel burns about 1.4 hours. At $22 per hour fully loaded, that’s around $30 per day—$900 per month. Not fatal, but real. Add 1% reships from bad labels and it stacks fast.

Invisible costs to budget for:

- Support tickets from tracking mismatches add overhead and slow the team.

- Invoice reconcile takes longer when DIM adjustments spike across SKUs.

- Training time: ramping packers on the new flow is a one-time hit. Plan it.

Build to bounce back

Treat as change project

Don’t hardcode today’s workaround. Build your flow with a feature flag for “SPD unknown-carton,” and keep LTL paths distinct. When the API adds support, you want a one-click switch, not a rewrite.

Design principles:

- Split rate-quoting from label-creation logic so you can move label timing.

- Isolate carrier adapters; hide USPS and FedEx logic behind clean interfaces.

- Log every label attempt with inputs and outputs. You’ll need this for audits and rollback tests.

Sandbox return to prelabeling

When SPD support lands, test in a sandbox or dev account with real patterns. Include multi-pack orders, heavy items, and fragile SKUs. Check logs for rate calls, label creation, voids, and tracking updates. Confirm carriers accept manifests aligned with your labels.

Pilot playbook:

- Run 50 orders across low, medium, and high weight bands.

- Include at least one multi-carton order to validate MPS behavior.

- Intentionally void and recreate a few labels; confirm clean closeout and no duplicates.

- Reconcile carrier invoices for the pilot window before you scale.

Watch release notes

No public timeline means you need a monitoring habit. Assign an owner, set a weekly check for API release notes, and keep a runbook. “When support appears, test these five cases, run a 50-order pilot, then scale.”

First-hand example: A 3PL kept its old pre-label builder dormant behind a flag. When a prior API restored a deprecated field, they re-enabled it in an afternoon. The harness and tests were waiting. Same playbook here.

Quick recap before scrolling

- SPD with unknown carton-level info isn’t fully supported in v2024-03-20; LTL is fine.

- USPS and FedEx need per-carton data to produce compliant labels.

- Shift cartonization to pack time or use a hybrid “print locally, upload tracking” flow.

- Expect small time and labor bumps; avoid DIM surprises by labeling after weigh and measure.

- Build flags and monitoring so you can flip back to pre-labeling fast.

If you optimize around those five bullets, you’ll protect SLAs and margins. You’ll also keep the warehouse calm when peak hits hard.

FAQ what shippers ask

- Q: Can I still create SPD shipments if I know all carton details upfront?

A: Yes. If you have final per-carton details—weight, dimensions, count—you can request labels as usual. The limit hits when shipments are created without knowing those specifics first.

- Q: Does this impact USPS and FedEx differently?

A: The rule is the same for both. Each needs package-level data to generate labels. USPS enforces IMpb; FedEx rating and labels rely on per-package attributes. The impact is your workflow timing.

- Q: Is there a published date for full SPD support with unknown carton info upfront?

A: No public timeline yet. Best move: watch release notes and keep a feature-flagged path ready to re-enable pre-labeling when support appears.

- Q: Should I switch everything to LTL?

A: No. LTL is great for consolidated, heavier, or B2B shipments. Not for single-order DTC parcels. Use LTL where it fits; keep SPD for the rest—just move labeling after pack.

- Q: Can I pre-estimate box sizes to keep pre-labeling alive?

A: You can, but it’s risky. If dims differ, you’ll face billing changes and rework. Carriers compute rates and rules off final carton data. Safer path is label after weigh and measure.

- Q: What about uploading tracking if I print labels outside the API?

A: That’s a solid hybrid. Generate labels via carrier tools once cartons are final. Then upload tracking numbers to keep customers informed and orders closed out.

- Q: How do multi-piece shipments (MPS) fit into this?

A: MPS makes accuracy even more important. Labels often reference a master tracking number with child packages. If you don’t know counts, weights, and dims, you can’t generate the full set. Capture all cartons at pack, then label.

- Q: Will checkout rates be wrong if I move labels later?

A: They can drift if estimates go stale. Use SKU-to-box mappings and update averages weekly from invoices. Add a small buffer for bulky items.

- Q: Should I buy a dimensioner to speed this up?

A: If your catalog is box-diverse and DIM hits often, a dimensioner can pay for itself. If 80% of orders use 3–4 standard boxes, start with scales and a tight box library first.

- Q: What about international shipments?

A: International adds customs data that must match the physical carton. That’s more reason to label after pack. You avoid customs mismatches that delay clearance. Keep commercial invoices synced to final specs.

- Q: Can I auto-select the best service without labels upfront?

A: Yes. Rate shop using expected dims and weights at order creation. Then finalize the service after pack when you have actuals. If it changes, update the order and notify customers if timelines shift.

Your playbook to move parcels

- Move cartonization to pack benches; add scales and quick-dim tools.

- Print labels after weigh and measure; minimize voids and DIM risk.

- Use LTL for multi-case replenishments or oversized orders.

- Pilot offline carrier tools; upload tracking back into your OMS.

- Add a feature flag for pre-labeling; keep that code path warm.

- Monitor release notes weekly; schedule a flip-back test plan.

- Train packers on the new flow; measure seconds saved per step.

- Audit invoices for DIM changes; tweak your box library as needed.

Turn that list into action with a short sprints roadmap:

Week 1

- Add scales to every active station; map SKUs to default boxes.

- Update pack screens to require weight and dims before label calls.

- Stand up a tracking-ingestion endpoint for the hybrid path.

Week 2

- Pilot two lanes with “label after pack.” Compare throughput and error rates to your old flow.

- Start weekly invoice audits; log DIM adjustments by SKU and box.

- Train team leads on exceptions like voids, service swaps, and partials.

Week 3

- Expand to all stations; tune prompts and defaults based on real bottlenecks.

- Implement the feature flag and keep pre-label code dormant but healthy.

- Document your cutover checklist for when full SPD support returns.

What to watch while you iterate:

- Order-to-first-scan time: keep it stable, even if label timing shifts.

- Label void rate: should drop when you label after pack.

- DIM adjustment rate: should fall as your box mapping improves.

- Station throughput: seconds saved or lost per parcel is your north star.

You didn’t choose the “no carton info upfront” game—but you can still win it. SPD is strict because each package is its own contract. So treat labels like contracts: only sign once you know what’s in the box. Shift work to the right spot, keep options open with flags, and be ready to bounce when full support lands.