Win Regions Fast: Master Geographic Optimization in AMC & DSP

Jacob Heinz

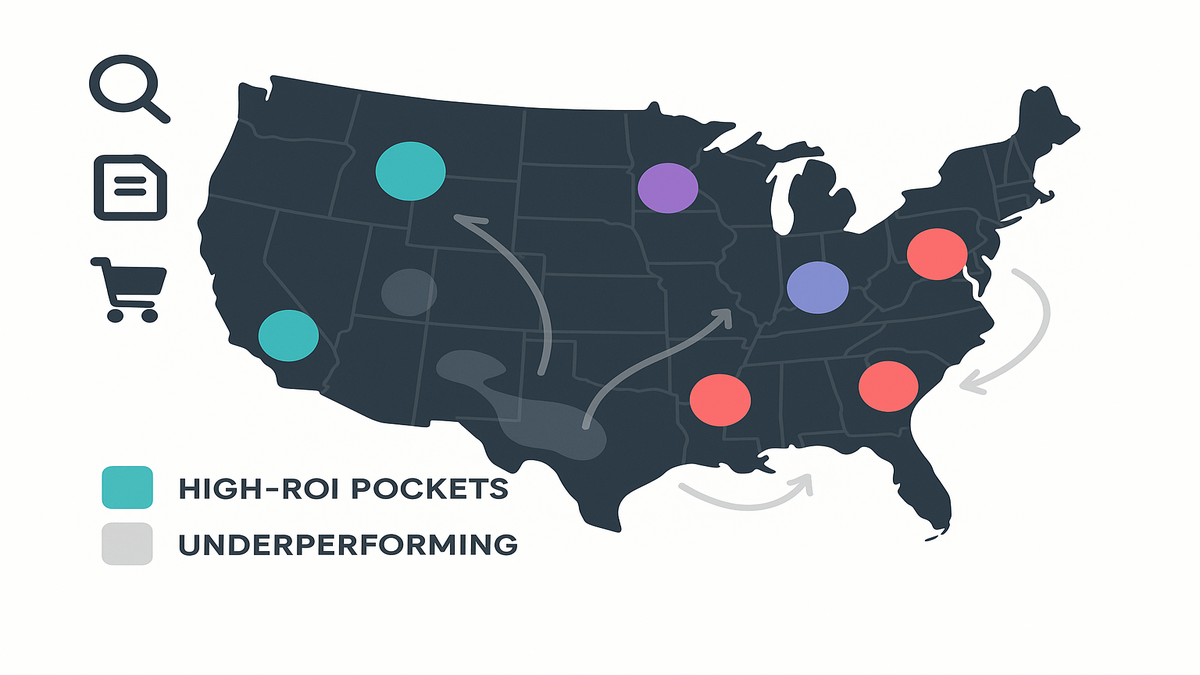

You’re leaving money on the map.

The same national budget can work 2x harder in the right ZIPs and DMAs. Amazon first‑party retail signals plus smart geo in DSP = better ROAS without more spend.

What to use

- Geographic Insights and Activation (GIA) in Amazon DSP to spot over- and under-index areas and build location groups.

- Amazon Marketing Cloud (AMC) to measure, diagnose, and forecast by geo in a privacy-safe way.

Price

- AMC: available at no extra cost for eligible Amazon Ads advertisers. You still pay your normal media costs in DSP. Using partner tools or data egress can add fees.

Performance

- Expected impact: shift spend from low-yield areas to high-propensity ZIPs/DMAs, lowering cost per incremental action while keeping or growing scale.

- Proof: run geo holdouts and pre/post reads in AMC to quantify incremental orders and new-to-brand by region.

Quick start playbook

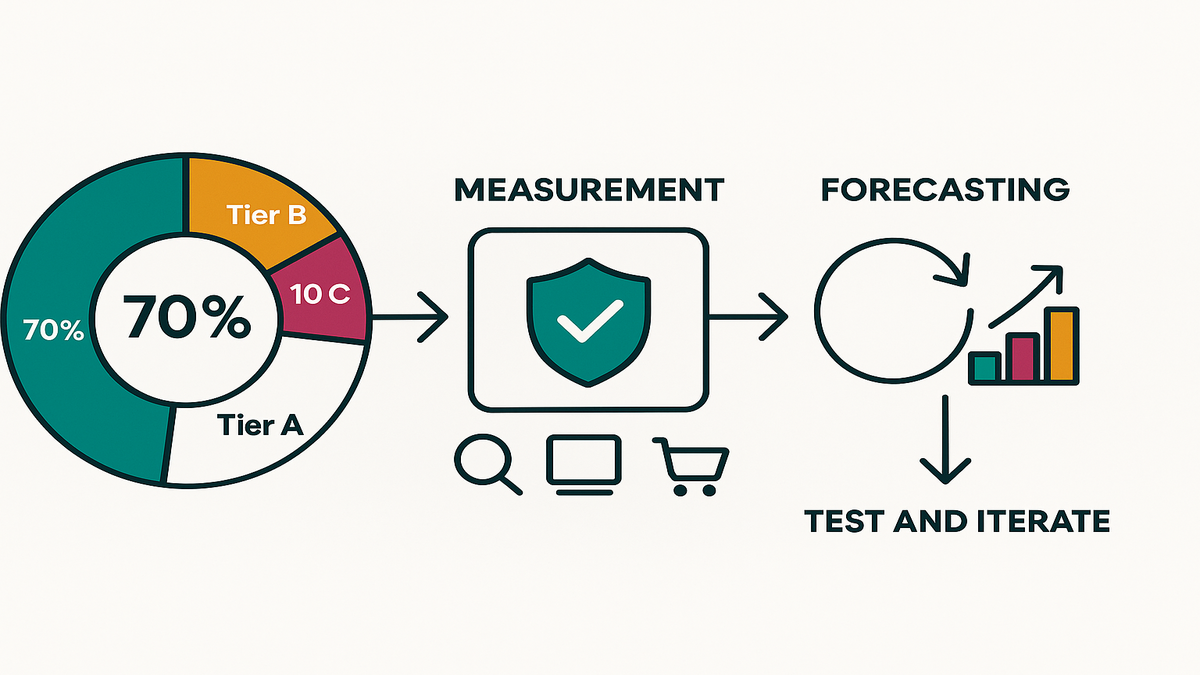

- Tier A (70%): best-performing DMAs or ZIP clusters. Higher bids, looser frequency caps, strongest creative.

- Tier B (20%): challengers with rising AMC signals (search, PDP views, add-to-carts) but mixed sales. Balanced bids, test mid-funnel.

- Tier C (10%): test cells for new creatives, betas, or fresh-to-brand pushes.

Operationalize in 3 weeks

Week 1

- Baseline: export last 8–12 weeks by DMA or ZIP. Compute your share vs category, conversion lag, in-stock, and delivery promise by region.

- Cluster: group adjacent ZIPs to ensure volume. Create 3–6 location groups to start.

- Set rules: example, if category growth up and brand share down, prioritize prospecting in that geo.

Week 2

- Activate in DSP with GIA location groups. Mirror audiences across groups so comparisons stay clean.

- Creative by geo: call out shipping speed where delivery is faster; seasonal hooks by region.

- Controls: avoid overlapping geos across campaigns; apply frequency caps per group.

Week 3

- Measure in AMC: set matched geo holdouts; track incremental orders, new-to-brand, and cost per incremental action.

- Reallocate: promote winners to Tier A, trim laggards, and add 1–2 new test clusters.

Targeting guidance

- Start with DMAs for stability. Move to ZIP clusters where retail signals change block to block. Use radius around stores for BOPIS or retail pushes.

- Keep minimum weekly spend per group to reach statistical power; if a group cannot hit thresholds in 2 weeks, merge it.

Forecasting with AMC signals

- Watch week-over-week changes in category search, PDP views, and add-to-carts by geo.

- If search up but PDP flat, add upper funnel in that market. If PDP up but ATC soft, address objections with mid-funnel creative. If ATC up but orders lag, tighten retargeting and check delivery promises.

Cadence

- Weekly: refresh GIA maps, adjust tiers, move 10–20% budget based on AMC signals.

- Biweekly: rotate creatives per group. Monthly: re-cluster ZIPs and revisit thresholds.

Common pitfalls to avoid

- Oversplitting the map: too many small groups makes noise. Earn precision over time.

- Chasing noise: require two consecutive positive weeks before big shifts.

- Ignoring fulfillment: don’t push hard into out-of-stock or slow-ship geos.

- Misattribution: align lookback windows to each region’s conversion lag.

FAQ highlights

How granular can DSP go: country, state, DMA, ZIP, and radius (varies by market).

Does geo hurt scale: no. With DMAs plus ZIP clusters for precision, reach stays intact.

Non-endemic use: yes. Drive off-Amazon outcomes by biasing spend to store-adjacent ZIPs and fast-converting regions.

Bottom line

You don’t need more budget. You need better geography. Use GIA to find pockets, use DSP to activate, and use AMC to prove incrementality. Route spend to where demand lives this week, not where averages say it might.