Boost ROI With AMC and DSP Geographic Optimization

Stop treating every ZIP the same, like they all behave identical.

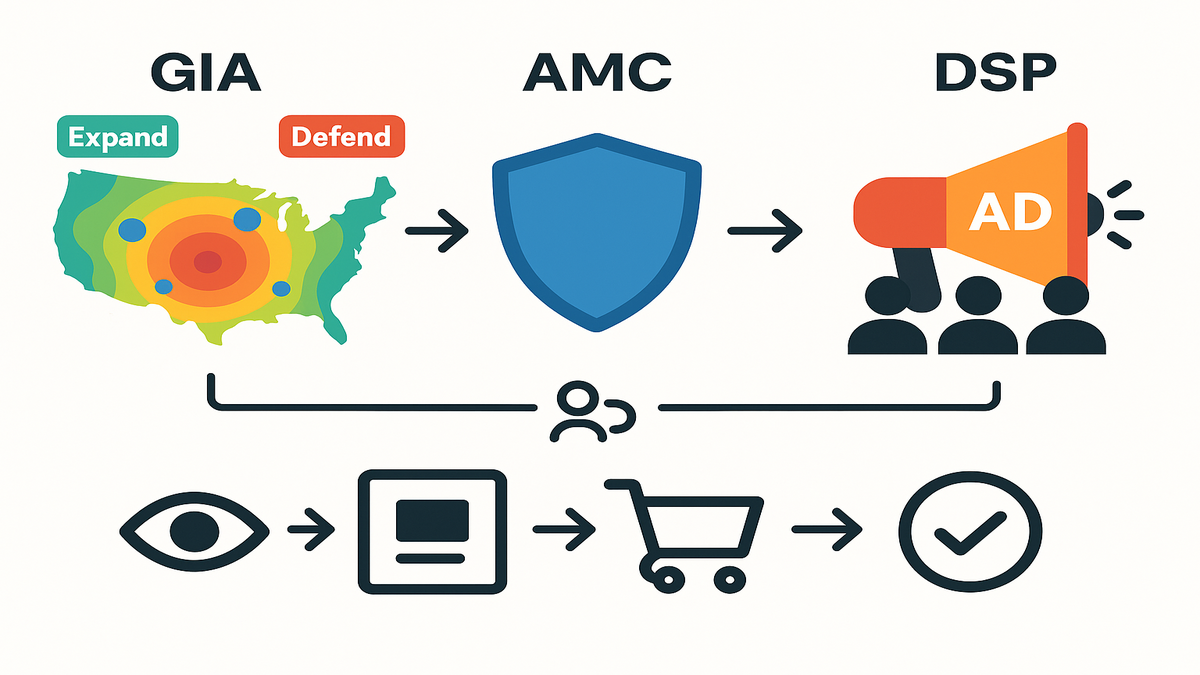

With Amazon DSP, Amazon Marketing Cloud (AMC), and Geographic Insights & Activation (GIA), you get control. Push spend into high-probability ZIPs, and pull back where intent is weak. Then measure real, incremental outcomes without giving up privacy. Simple as that.

Want help putting this playbook into practice? Explore our DSP Services and privacy-safe AMC Cloud to operationalize geo-driven planning, activation, and measurement.

Here’s the move: stop flattening performance into one national average. Use geography as your multiplier and edge. Some ZIPs are quietly on fire—high intent, fast delivery SLAs, and repeat buyers. Others are tire-kickers or they’re out of stock this week. GIA finds the hotspots, AMC proves what’s working, and DSP hits the right message at the right price. You keep privacy tight, and growth stays steady.

Think like a portfolio manager, not a tourist. Allocate more to ZIP clusters with the best expected outcomes. New-to-brand, subscribe rate, and LTV tell you where to lean in. Trim where the funnel leaks and waste hides. Then test, learn, and reallocate—every single week. No hand-waving, no guesswork—just clean signals and measured lift.

When teams do this well, CPM drama fades and outcomes take the mic. You stop paying for curiosity clicks and start funding incremental conversions. If you want a playbook you can actually ship Monday morning, keep reading.

TL;DR

- Use GIA to find high-opportunity ZIPs and form smart location groups.

- Use AMC to join geo, retail, and funnel signals; activate audiences to DSP.

- Optimize to outcomes (new-to-brand, subscriptions, LTV), not CPM.

- Run weekly geo-lift tests; adjust bids, frequency, and creative by ZIP cluster.

Let’s unpack how each piece fits together. And where to push for outsized gains without blowing up your budget or privacy posture.

Why geography beats averages

- Customers behave differently by ZIP: price sensitivity, timing, delivery SLAs, and competition all vary.

- GIA flags expand vs defend ZIPs using category demand and your brand share.

- AMC shows where the funnel leaks by region: impressions to PDP, cart, purchase.

Averages hide the truth, and they hide it well. In one ZIP, people buy on first touch because delivery is next-day. Your closest competitor is out-of-stock, so it’s easy. Twenty miles away, shoppers wait for a deal and browse on mobile at night. They finish on desktop at lunch. Same product, same creative—completely different outcomes.

GIA is your map, plain and simple. It surfaces where category demand is rising and where your brand under- or over-performs. Use that to define three buckets: expand, defend, and test. Expand means high category demand and low brand share. Defend means high share with visible competition in the mix. Test is unknowns worth small, smart bets. These clusters give you scale without losing precision. No chasing single ZIP outliers that can’t scale.

AMC is your magnifying glass for the funnel, by region. Are impressions turning into PDP views, or are they stalling out? Are carts converting at a healthy clip? How long is the lag between exposure and purchase? Which devices and dayparts matter by ZIP cluster? Find the leak, then fix it with targeted bids, frequency, and creative.

The best part: optimize by cluster, not a national average, and you win twice. You protect spend from weak-intent areas and fuel the ones with higher outcome odds. Simple reallocation, big lift. It’s kinda obvious once you see it.

What to measure in AMC

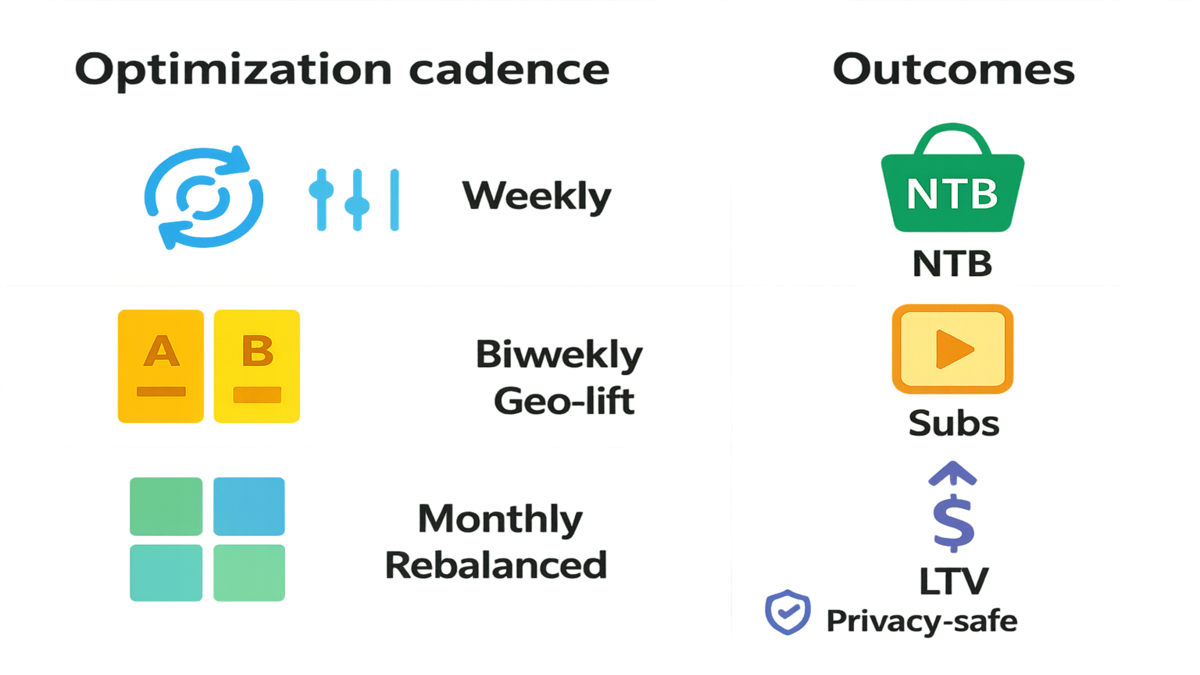

- New-to-brand rate by location group.

- Post-exposure time-to-purchase and subscribe rate.

- Funnel conversion by device/time (mobile evenings vs desktop daytime).

- LTV by region to justify higher CPMs when outcomes warrant it.

Start with new-to-brand (NTB). If a ZIP cluster brings in a high NTB rate, that’s future growth. Double down even if CPMs are higher in that cluster. Your CAC can drop when repeat value is counted. AMC lets you segment outcomes by cluster and tie them to media exposure. So you’re not optimizing blind or guessing in the dark.

Next, check time-to-purchase after exposure by cluster. Some clusters convert same day with minimal nudges. Others need three touches across a week or two. If you see longer lags, don’t panic or yank budgets. Adjust frequency caps and keep your sequence intact. Pulling spend too early hands win-now ZIPs to your competitors.

Device and daypart matter more than most teams think. If mobile evenings drive PDP views, index there to spark interest. If desktop lunchtime closes, shift bids to land the sale. AMC queries break this down cleanly by cluster, so you’re not guessing. No need to lean on generic device trends that blur the truth.

Finally, look at LTV by region and cluster. An urban ZIP with high subscribe-and-save can support a higher CPM. A curiosity-heavy suburban ZIP probably can’t justify it yet. When you anchor to LTV and incremental conversions, CPM is a tactic, not the scoreboard.

Pro tip: build a simple scorecard per cluster. Track NTB, subscribe rate, time-to-purchase, and last-30-day LTV. Re-rank weekly and keep it honest. If a cluster is top-quartile on two or more metrics, consider incremental budget.

Bidding and pacing

- Raise bids where expected CAC and LTV justify higher CPMs; cap curiosity ZIPs.

- Pace budgets to when and where purchase probability peaks.

- Protect CX: if inventory is tight in a hot ZIP, cap bids and swap to waitlist messaging.

Treat bids like signals, not emotion or vibes. Start with a baseline bid per cluster tied to expected CAC. If AMC shows high NTB and a strong subscribe rate, add a premium. If a cluster looks clicky but weak on carts or purchases, cap bids. Keep frequency tight and stop the leak. You’re buying expected outcomes, not cheap impressions.

Pacing is where most accounts leak spend, week after week. Purchase probability isn’t flat across the week or month. Line up media with demand and real-world spikes. Think tax-free weekends, back-to-school, local sports finals, and weather swings. If a cold snap hits your “heater use-case” cluster, nudge bids and budgets for 72 hours. AMC lift reads will confirm if it paid off, or not.

Customer experience guardrails matter more than folks admit. If inventory is low in a hot ZIP, don’t ghost the region entirely. Switch to waitlist or preorder messaging and cap bids. You protect trust and keep the funnel warm, avoiding cancellations.

Think in tiers:

- Tier 1 clusters: higher bids, broader reach, relaxed frequency caps, varied creative.

- Tier 2 clusters: baseline bids, tighter frequency, decision-making creative up front.

- Tier 3 clusters: controlled testing with clear, firm stop-loss rules.

This gives you structure, not chaos, when the weekly numbers roll in.

Creative localism

- Localize to context, not clichés: delivery speed, pickup radius, financing, and climate use cases.

- Sequence by funnel stage: research first, offer next, and trust signals third.

Skip the postcard clichés and wink-at-the-camera lines. Local context wins every time. If a cluster has two-day delivery and strong pickup radius, say it loudly. If it’s price sensitive, spotlight financing, bundles, or subscribe-and-save. If climate drives demand, match the use case to this week’s weather. Don’t push summer copy in a cold snap ZIP.

Build your sequence like a real conversation, not a script.

- Research creative: quick demo, problem/solution hook, and local product fit.

- Decision creative: offer mechanics, financing terms, or bundle details by cluster.

- Trust creative: testimonial from a similar location, rating badge, or social proof.

Match formats to behavior, not your preferences. If mobile evenings drive PDP views, lead with short video. Use swipeable cards that reward quick, curious thumbs. If desktop lunch converts, run comparison charts and reviews. Use units that reward dwell time and calm reading. You’re not changing the product—you’re changing the conversation to fit the moment.

Lastly, let performance prune the creative tree each week. Pause weak variants at the cluster level without mercy. Replace them with new angles informed by AMC funnel reads.

Testing cadence

- Weekly: refresh GIA, re-rank ZIP clusters; adjust bids ±10–20% from AMC outcomes.

- Biweekly: geo-lift test one variable across matched ZIPs, clean controls.

- Monthly: rebuild clusters and reallocate 10–20% of spend to winners.

Weekly is about tuning, not reinventing the whole plan. Refresh your GIA view and confirm top and bottom clusters. Push small bid and frequency changes where the data points. If a cluster’s NTB jumps, reward it quickly. If time-to-purchase stretches too long, tighten caps or sequence.

Biweekly is for structured tests with discipline. Pick one variable and run a geo-lift test across matched ZIPs. Keep controls clean on demand, seasonality, and baseline KPIs. Measure incremental outcomes in AMC, not just in-platform metrics. Document the read and roll the winner into your weekly plan.

Monthly is for reshaping the portfolio with intent. Rebuild clusters if demand shifted or new patterns appear. Promote “test” clusters that actually proved lift. Move 10–20% of spend into top performers. Pull back from the underperformers without drama. The trick is staying steady: small weekly moves, bigger monthly moves, always tied to clean reads.

Pro tip: keep a living doc of test hypotheses, setups, and outcomes. That’s how you avoid rerunning the same test four months later.

Checklist to ship

1) Map demand with GIA: rank ZIPs by category demand vs brand share. 2) Cluster ZIPs: expand, defend, test. Avoid overfitting to single ZIPs. 3) Query AMC: compute funnel rates, new-to-brand, subscribe, LTV by cluster. 4) Set DSP bids: prioritize clusters with superior down-funnel outcomes. 5) Localize creative to context (delivery promises, inventory, climate, commute). 6) Run geo-lift: matched test/control ZIPs; read incremental sales in AMC. 7) Reallocate weekly: move budget into clusters with proven lift and LTV.

Turn the checklist into a standing ritual your team trusts.

- Monday: refresh GIA and publish the ranked cluster list.

- Tuesday: pull AMC queries, update the scorecard, and flag surprises.

- Wednesday: set DSP bid and frequency changes; ship creative swaps.

- Thursday: QA geo-lift tests, confirm controls, and lock the readout plan.

- Friday: share a one-pager—what moved, what you’re testing, and next week’s budget flow.

If you keep this drumbeat, the program compounds fast. Small, frequent, well-measured changes beat big swings. Forget “set it and forget it.” That playbook wastes money.

Privacy and governance

- AMC is a clean room: use aggregated, anonymous analysis and compliant joins.

- Export only audience aggregates to DSP; avoid importing raw PII.

Treat privacy like uptime—non-negotiable, always on. AMC is built for privacy-safe analysis with aggregated outputs. Keep joins compliant and restrict raw identifiers across your stack. Stick to audience-level activations and clustered reads. You don’t need line-level detail to make sharp decisions.

Limit exports to what you actually need, not everything. Audience aggregates to DSP? Yes, ship it. Raw PII? No, absolutely not. Store query templates in version control and log who ran what. Keep access scoped to only the folks who need it. If legal asks how the sausage is made, you can show your process.

Finally, check your creative, data use, and measurement plans against platform policies. Clean room discipline is a competitive advantage. Privacy and performance can coexist when you design for both from day one.

FAQs

1) How granular? Start at DMA for signal; move to ZIP clusters for performance. Use GIA smart groups to balance scale and precision.

How granular? Think funnel health first, then precision that actually scales. DMAs can reveal macro trends and seasonality at a glance. ZIP clusters unlock budget efficiency when you push for performance. Use GIA grouping to avoid chasing tiny pockets that can’t scale. When in doubt, cluster for reach, then tailor bids and frequency inside the group.

2) Will CPMs rise? Sometimes—and that can still lower CAC if new-to-brand and subscribe rates improve. Optimize to incremental outcomes, not CPM alone.

Will CPMs rise? In some clusters, yes—and that’s more than okay. If the audience is higher quality and AMC proves stronger NTB or subscribe rates, CAC falls. Remember, CPM is a lever, not the scoreboard. Keep the scorecard centered on NTB, subscribe, and LTV.

3) What to test first? Bids by cluster, then frequency by region, then localized creative. One variable per sprint.

What to test first? Start with bids because they set the floor for attention. Then tune frequency by region—overserving weak-intent clusters gets expensive. When bids and frequency are stable, roll in localized creative. Speak to delivery, price sensitivity, or climate needs. Keep tests clean: one variable at a time, matched ZIPs, AMC readouts.

References

- Amazon Marketing Cloud overview

- Amazon DSP overview

- AMC Learning (clean rooms & privacy-safe measurement)

- IAB Location-Based Advertising Measurement Playbook

You do not need a bigger budget—you need a sharper map, honestly. Combine GIA’s heatmaps with AMC’s privacy-safe measurement to compound results ZIP by ZIP.

Here’s the final word: this isn’t a hack; it’s a system that compounds. Map demand with GIA. Read the funnel with AMC. Point DSP at the clusters that actually convert. Keep privacy tight, and keep tests honest. Every week, slide more budget into what’s working. Turn down what’s not. That’s how brands build steady, compounding growth without chasing yesterday’s CPMs or this week’s shiny object.

If you’re ready to turn this from a deck into a daily habit, we can help. We’ll help you operationalize the whole playbook, end to end. The fastest wins come from teams that ship the first version, measure hard, and iterate fast. Your future budget will thank you.